The police part of the council tax bill in Dyfed and Powys is expected to rise by nearly nine per cent, meaning the average household could be paying £360 for that element alone.

The overall council tax bill for residents in the counties of Pembrokeshire, Ceredigion, Carmarthenshire and Powys is made up of the county council element of the council tax, the Dyfed-Powys Police precept, and individual town or community council precepts.

In a summary before the January 24 meeting of the Dyfed Powys Police and Crime Panel, to be held at County Hall, Haverfordwest, Police and Crime Commissioner Dafydd Llywelyn calls for a raising of the precept by nearly nine per cent for the 2025-’26 financial year.

The summary ahead of the meeting later this week says: “After extensive scrutiny by the Police & Crime Panel (P&CP), I was unanimously supported in setting a council tax precept for 2024/25 in Dyfed-Powys of £332.03 for an average band D property, once again being the lowest in Wales.

“At every stage within the series of precept and medium-term financial plan meetings, and indeed through my scrutiny and review of the in-year financial position, I critically question and constructively challenge aspects of the revenue budget requirement and organisational delivery structure to assure myself of the requirements, progress and ultimate delivery. I also undertook a series of challenge and scrutiny sessions specifically reviewing the Estates, ICT and Fleet Strategies and future capital programme.

“To inform my considerations for 2025/26 and to fulfil my responsibilities as Commissioner, I consulted with the public to obtain their views on the level of police precept increase. It was pleasing to see an increase in respondents since 2024/5 with 76 per cent supporting a precept increase above Nine per cent.”

It added: “I am painfully aware of the pressures that the cost-of-living crisis continue to put on our communities. There is a fine balance between ensuring an efficient and effective, visible and accessible Policing Service, addressing operational services demands to ensure the safety of the public, whilst also ensuring value for money for the taxpayers and sound financial management.

“Having undertaken a comprehensive process, I am confident in the robustness of this MTFP, but this does not underestimate the difficult decisions or indeed mitigate the financial challenges and uncertainties which are outside of our control.

“I therefore submit my precept proposal for scrutiny by the Dyfed- Powys Police and Crime Panel, which will raise the average Band D property precept by £2.39 per month or £28.65 per annum to £360.68, an 8.6 per cent increase. This increase will raise a total precept of £86.366m.

“This will provide a total funding of £153.304m, representing a £9.4m/6.5 per cent increase on the revised funding for 2024/25.”

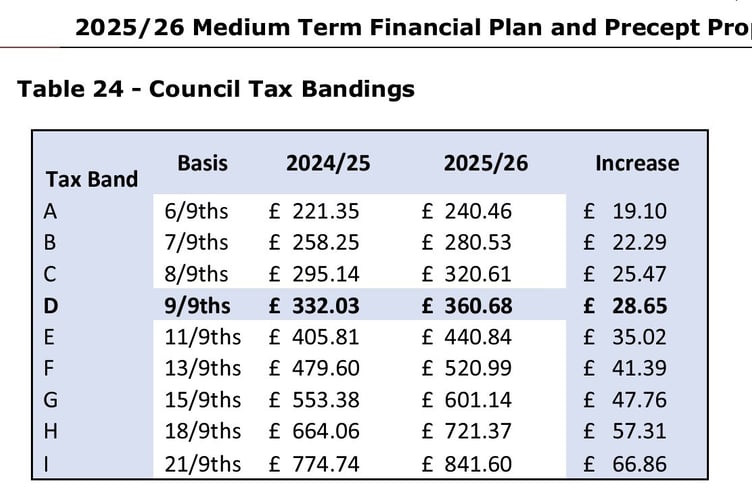

For the individual council tax bands of A-I, the proposed levels, and increase on last year, are: £240.46 (+£19.10), £280.53 (+£22.29), £320.61 (+£25.47), £360.68 (+£28.65), £440.84 (+£35.02), £520.99 (+£41.39), £601.14 (+£47.76), £721.37 (+£57.31), and £841.60 (+£66.86).

The final decision on the proposal will be made at the January meeting, with local authorities due to decide their council tax levels in February and March.

Ceredigion is currently mooting a near-10 per cent increase in that element of the overall council tax bill.

Anyone paying a premium on council tax, such as second home-owners, also pay the premium on the police precept, meaning their bills for this element are proportionately higher.